Employers need to understand the latest IRS pertaining to the ACA, what their obligations are and have systems in place for tracking and calculating reportable costs. For many, the reporting requirement became effective for the 2012 tax year— but for qualifying small employers (filing less than 250 W-2’s) many of these obligations will take effect for the 2013 tax year. Continue reading

Tag Archives: W-2

More Information on W-2 Reporting Requirements for Employers

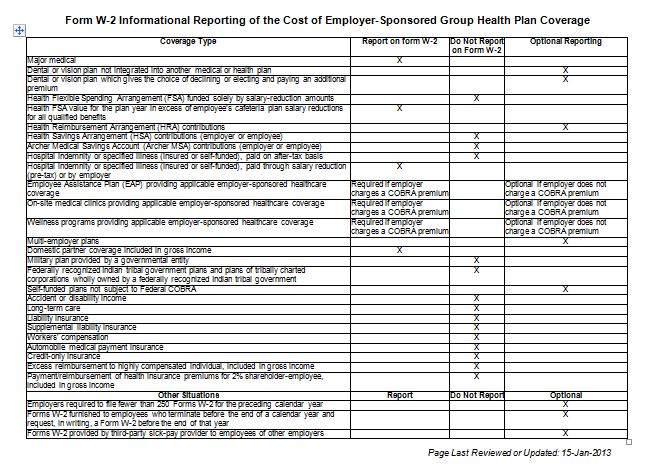

Not sure what to report on W-2, optional or mandatory?

Our table is based on IRS Notice 2012-9, which, until further guidance, contains the requirements for tax-year 2012 and beyond. Items listed as “optional” are designated as such based on transition relief provided by Notice 2012-9, and their “optional” status may be changed by future guidance. However, any such change will not be applicable until the tax year beginning at least six months after the date of issuance of such guidance. Continue reading

Employer-Provided Health Coverage Informational Reporting Requirements: Questions and Answers

IRS Q&A Affordable Care Act Reporting Requirements

The Affordable Care Act requires employers to report the cost of coverage under an employer-sponsored group health plan. To allow employers more time to update their payroll systems, Continue reading

Informational Reporting of the Cost of Employer-Sponsored Group Health Care Plan Coverage

Not sure what to report on W-2, optional or mandatory?

This table is based on IRS Notice 2012-9, which, until further guidance, contains the requirements for tax-year 2012 and beyond. Items listed as “optional” are designated as such based on transition relief provided by Notice 2012-9, and their “optional” status may be changed by future guidance. However, any such change will not be applicable until the tax year beginning at least six months after the date of issuance of such guidance.

This table was created at the suggestion of and in collaboration with the IRS’ Information Reporting Program Advisory Committee (IRPAC). IRPAC’s members are representatives of industries responsible for providing information returns, such as Form W-2, to the IRS. IRPAC works with IRS to improve the information reporting process.