Methodology

Methodology

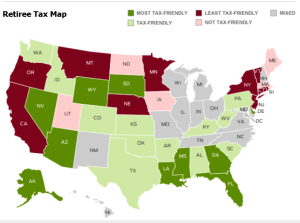

Retirement is something we want to look forward to. Some have planned this *future* … others, not so much. To get an idea of what you have in contrast to what you will need, CNN’s article “Will You Have Enough To Retire” includes an online calculator.

**************************************

This calculator estimates how much you’ll need to save for retirement. To make sure you’re thinking about the long haul, we assume you’ll live to age 92. But you could live to be 100 or incur large medical bills early on in retirement that may raise your costs even further. Social Security is factored into these calculations, but other sources of income, such as pensions and annuities, are not. All calculations are pre-tax.

The results offer a general idea of how much you’ll need and are not intended to be investment advice. The results are presented in both future dollars (at retirement) and today’s dollars, which is calculated using an inflation rate of 2.3%.

USE CNN ONLINE CALCULATOR http://money.cnn.com/calculator/retirement/retirement-need/

How we calculate your savings goal

First, we determine what your income will be at the time you retire by growing your current income at an annual rate of 3.8% (the inflation rate of 2.3%, plus the salary growth rate of 1.5%). We then assume you can live comfortably off of 85% of your pre-retirement income. So if you earn $100,000 the year you retire, we estimate you will need $85,000 during the first year of retirement. For each subsequent year, we increase your income need by 2.3% to keep up with inflation. We then factor in Social Security by subtracting your estimated benefits (more on that below) since that income will reduce the amount you will need to save.

The second step is to calculate the total savings you will need at the time you retire, in order to generate enough income for each year of retirement. To do this, we determine what it would cost to purchase a fixed income annuity, with inflation-adjusted payments, using a discount rate (or rate of return) of 6%. The cost to purchase this hypothetical annuity is your target savings goal.

How we calculate the amount you will save

To figure out how much you will save by the time you retire, we first estimate your future income by growing your current income at a rate of 3.8% (the inflation rate of 2.3%, plus the salary growth rate of 1.5%). Then, we determine what the sum of your annual contributions will be between now and retirement. We assume your current savings and future contributions are invested and will earn an average annual rate of return of 6%.

How we estimate Social Security benefits

We estimate your Social Security benefits based on the assumption that you will have worked at least 35 years and will start collecting benefits at age 67. For most people who are working today, that’s considered full retirement age. If you plan on retiring after age 67, we assumed the benefits are invested (along with your savings) and grown at the same average rate of return of 6%. We use your estimated pre-retirement income to calculate your estimated annual Social Security benefits, based on current benefit formulas and accounting for inflation. To better understand your actual Social Security benefits, please visit www.ssa.gov.

Sources: Social Security Administration; Federal Reserve of Philadelphia; Department of Labor; CNN http://money.cnn.com/calculator/retirement/retirement-need/

IRS Answers, ‘Canceled Debt – Is It Taxable or Not?’

IRS Answers, ‘Canceled Debt – Is It Taxable or Not?’

Facebook, GE, Johnson & Johnson and other stocks that Baby Boomers love.

Facebook, GE, Johnson & Johnson and other stocks that Baby Boomers love.

Millennials Are Planning to Save Tax Refund

Millennials Are Planning to Save Tax Refund

If you’re a parent, here are several tax benefits you should look for when you file your federal tax return:

If you’re a parent, here are several tax benefits you should look for when you file your federal tax return: Methodology

Methodology Continuing Education for the entrepreneur, start-up and small business owner.

Continuing Education for the entrepreneur, start-up and small business owner.  Have you set up your appointment to have taxes done?

Have you set up your appointment to have taxes done?

Take Advantage of Credits and Deductions

Take Advantage of Credits and Deductions  CHILD AND DEPENDENT CARE EXPENSES.

CHILD AND DEPENDENT CARE EXPENSES.