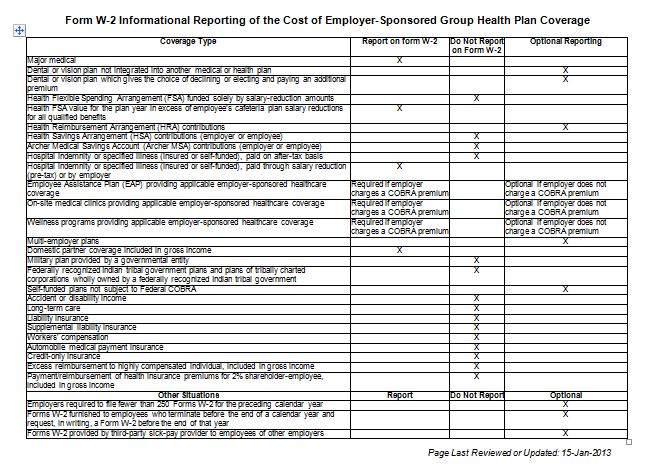

Not sure what to report on W-2, optional or mandatory?

Our table is based on IRS Notice 2012-9, which, until further guidance, contains the requirements for tax-year 2012 and beyond. Items listed as “optional” are designated as such based on transition relief provided by Notice 2012-9, and their “optional” status may be changed by future guidance. However, any such change will not be applicable until the tax year beginning at least six months after the date of issuance of such guidance. Continue reading