How Long Do You Really Need to Keep Your Financial Documents?

Now that April 15 has come and gone, everyone is writing about tax information, records to keep, and records you can discard. For some it’s just personal tax records. For others, it’s personal and business documents. However, before you go out and purchase electronic media to store records and receipts, please read our March 26 blog, Keeping Business Records.

Now that April 15 has come and gone, everyone is writing about tax information, records to keep, and records you can discard. For some it’s just personal tax records. For others, it’s personal and business documents. However, before you go out and purchase electronic media to store records and receipts, please read our March 26 blog, Keeping Business Records.

In a nut shell, you can only discard/destroy your hard copy books and records if the storage system has been tested and approved by the IRS. The IRS has specific requirements for electronic storage, and procedures have been established to ensure continued compliance with all rules and regulations. You still have the responsibility to retain any other books and records that are required by law, to be retained.

As for hard copies, when it comes to keeping financial documents, most adopt the “better safe than sorry” practice and find themselves drowning in papers and files. “While three years is standard, according to the IRS, it can perform an audit up to six years after taxes are filed if a “substantial error” is suspected. In the case of fraud, there is no limitation on an audit. If you are worried about being audited beyond the three-year limit, you should hold your documentation longer”, Entrepreneur Magazine, Posted by Stephanie Vozza | January 15, 2013 URL: http://www.entrepreneur.com/blog/225511

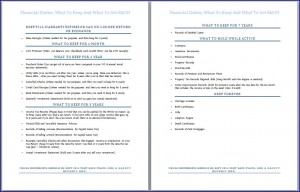

You can also see Financial Clutter, Guidelines on What To Keep and What To Get Rid Of and print out a pdf to keep as a checklist.

You can also see Financial Clutter, Guidelines on What To Keep and What To Get Rid Of and print out a pdf to keep as a checklist.

The following guidelines will help you in sorting your files. Anything you have questions about, you should contact your EA or CPA.

According to the IRS , you should keep records…

The length of time you should keep a document depends on the action, expense, or event the document records. Generally, you must keep your records that support an item of income or deductions on a tax return until the period of limitations for that return runs out.

The period of limitations is the period of time in which you can amend your tax return to claim a credit or refund, or that the IRS can assess additional tax. The below information contains the periods of limitations that apply to income tax returns. Unless otherwise stated, the years refer to the period after the return was filed. Returns filed before the due date are treated as filed on the due date.

Note: Keep copies of your filed tax returns. They help in preparing future tax returns and making computations if you file an amended return.

-

You owe additional tax and situations (2), (3), and (4), below, do not apply to you; keep records for 3 years.

-

You do not report income that you should report, and it is more than 25% of the gross income shown on your return; keep records for 6 years.

-

You file a fraudulent return; keep records indefinitely.

-

You do not file a return; keep records indefinitely.

-

You file a claim for credit or refund* after you file your return; keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later.

-

You file a claim for a loss from worthless securities or bad debt deduction; keep records for 7 years.

-

Keep all employment tax records for at least 4 years after the date that the tax becomes due or is paid, whichever is later.

The following questions should be applied to each record as you decide whether to keep a document or throw it away.

Are the records connected to assets?

Keep records relating to property until the period of limitations expires for the year in which you dispose of the property in a taxable disposition. You must keep these records to figure any depreciation, amortization, or depletion deduction and to figure the gain or loss when you sell or otherwise dispose of the property.

Generally, if you received property in a nontaxable exchange, your basis in that property is the same as the basis of the property you gave up, increased by any money you paid. You must keep the records on the old property, as well as on the new property, until the period of limitations expires for the year in which you dispose of the new property in a taxable disposition.

What should I do with my records for nontax purposes?

When your records are no longer needed for tax purposes, do not discard them until you check to see if you have to keep them longer for other purposes. For example, your insurance company or creditors may require you to keep them longer than the IRS does.