AN EDUCATED TAXPAYER IS OUR BEST CUSTOMER.

We help our clients understand the ever-changing federal and state tax laws so they can maximize their tax deductions, and adopt best recordkeeping practices.

Many of our clients have come to us after having a bad tax preparation experience that resulted in penalties and interest. When we come across a reference document that we feel is valuable for the taxpayer – we promote it.

Many of our clients have come to us after having a bad tax preparation experience that resulted in penalties and interest. When we come across a reference document that we feel is valuable for the taxpayer – we promote it.

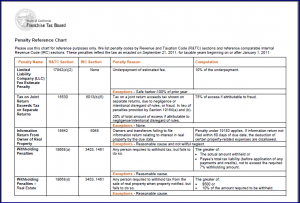

We have linked to the 18-page Penalties and Interest Reference Table published by the Franchise Tax Board of California.

- If I pay my taxes late, what interest and penalties will I be charged?

- What are past and current interest and estimate penalty rates?

- I have an extension of time to file my return. Why did I get a penalty?

- I filed my return on time. Why did I get a penalty?

Penalty reference chart (pdf)

Penalty reference chart (pdf)