Anyone that qualifies as a “First Time Home Buyer” can take up to $10,000 out of their IRA penalty free for certain purchase costs. BUT did you know it doesn’t have to be for your home purchase? Call for more information at (619) 589-8680 or use our contact form.

Anyone that qualifies as a “First Time Home Buyer” can take up to $10,000 out of their IRA penalty free for certain purchase costs. BUT did you know it doesn’t have to be for your home purchase? Call for more information at (619) 589-8680 or use our contact form.

Category Archives: IRS Tax Penalties

Hobby Tax Trap or For Profit Business?

What would happen if the IRS re-classified your business as a hobby?

What would happen if the IRS re-classified your business as a hobby?

It can happen. The IRS defines a hobby as a revenue-generating activity that lacks a profit motive. But what does that mean to you?

Most start-ups and small businesses have good years and not-so-good years. There are those that will say that if your business continually functions in the red, maybe you really need to rethink your business strategy. The IRS, on the other hand, will be looking at whether your business is really a for-profit business or is actually a hobby and the deductions or losses you have taken. “The IRS will generally assume an activity is a business if it generates a profit 3 of 5 consecutive years…“.¹ If the business has a loss for 3 of 5 consecutive years, the IRS will take a closer look at what they consider the “facts and circumstances” to evaluate whether the activity is actually a hobby or qualifies as a for-profit business.

Why is this important? Because if the IRS determines that your business doesn’t have a solid profit motive, they will re-classify your business as a hobby, then your past returns will be reviewed and deductions will be re-evaluated. If they feel your *activity* is actually a hobby, they will add back the losses claimed by you that will result in back-taxes, penalties and interest.

So here are a few tips that you should consider in support of your for-profit business in the event you are ever reviewed by the IRS. You want to be able to substantiate your business, and therefore entitled to any business losses you have claimed. These practices include being properly licensed, have separate bank accounts and credit cards, payment of business taxes, good accounting and record keeping, appropriate insurance, a separate business phone line, log or business journal of time devoted to the business and documented actions taken to help make the activity profitable.²

¹ Brett Hersh, http://www.hbsbusiness.com

² Ibid.

Need help? We do more than just tax preparation at US-TaxLaws. We are your best source for professional tax preparation and/or financial consulting services that include:

Personal Tax Preparation Business Tax Preparation Partnership Tax Preparation

Corporate Tax Preparation Incorporation-Choice of Entity Business Support Services

Corporate Compliance Audit Representation Retirement Tax Planning Wills & Trusts, Estate Planning Bookkeeping Payroll

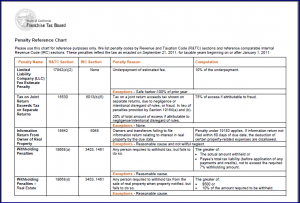

FTB Of CA Penalties and their meaning

AN EDUCATED TAXPAYER IS OUR BEST CUSTOMER.

We help our clients understand the ever-changing federal and state tax laws so they can maximize their tax deductions, and adopt best recordkeeping practices.

Many of our clients have come to us after having a bad tax preparation experience that resulted in penalties and interest. When we come across a reference document that we feel is valuable for the taxpayer – we promote it.

Many of our clients have come to us after having a bad tax preparation experience that resulted in penalties and interest. When we come across a reference document that we feel is valuable for the taxpayer – we promote it.

We have linked to the 18-page Penalties and Interest Reference Table published by the Franchise Tax Board of California.

- If I pay my taxes late, what interest and penalties will I be charged?

- What are past and current interest and estimate penalty rates?

- I have an extension of time to file my return. Why did I get a penalty?

- I filed my return on time. Why did I get a penalty?

Penalty reference chart (pdf)

Penalty reference chart (pdf)