2014 Inflation Adjustments

2014 Inflation Adjustments

IR-2013-87, Oct. 31, 2013

WASHINGTON — For tax year 2014, the Internal Revenue Service announced today annual inflation adjustments for more than 40 tax provisions, including the tax rate schedules, and other tax changes. Revenue Procedure 2013-35 provides details about these annual adjustments.

The tax items for tax year 2014 of greatest interest to most taxpayers include the following dollar amounts.

- The tax rate of 39.6 percent affects singles whose income exceeds $406,750 ($457,600 for married taxpayers filing a joint return), up from $400,000 and $450,000, respectively. The other marginal rates – 10, 15, 25, 28, 33 and 35 percent – and the related income tax thresholds are described in the revenue procedure.

- The standard deduction rises to $6,200 for singles and married persons filing separate returns and $12,400 for married couples filing jointly, up from $6,100 and $12,200, respectively, for tax year 2013. The standard deduction for heads of household rises to $9,100, up from $8,950.

- The limitation for itemized deductions claimed on tax year 2014 returns of individuals begins with incomes of $254,200 or more ($305,050 for married couples filing jointly).

- The personal exemption rises to $3,950, up from the 2013 exemption of $3,900. However, the exemption is subject to a phase-out that begins with adjusted gross incomes of $254,200 ($305,050 for married couples filing jointly). It phases out completely at $376,700 ($427,550 for married couples filing jointly.)

- The Alternative Minimum Tax exemption amount for tax year 2014 is $52,800 ($82,100, for married couples filing jointly). The 2013 exemption amount was $51,900 ($80,800 for married couples filing jointly).

- The maximum Earned Income Credit amount is $6,143 for taxpayers filing jointly who have 3 or more qualifying children, up from a total of $6,044 for tax year 2013. The revenue procedure has a table providing maximum credit amounts for other categories, income thresholds and phaseouts.

- Estates of decedents who die during 2014 have a basic exclusion amount of $5,340,000, up from a total of $5,250,000 for estates of decedents who died in 2013.

- The annual exclusion for gifts remains at $14,000 for 2014.

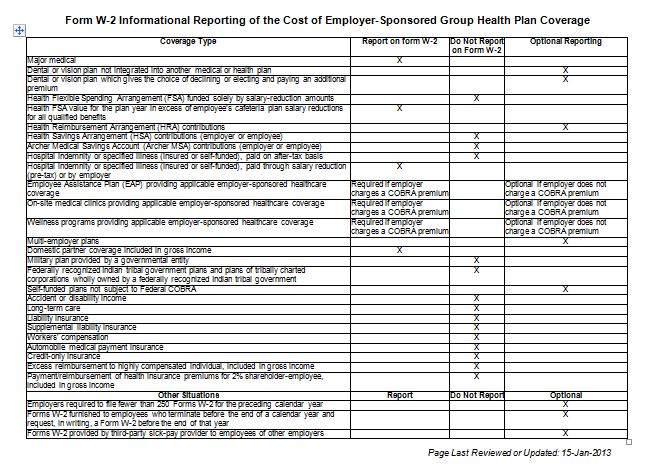

- The annual dollar limit on employee contributions to employer-sponsored healthcare flexible spending arrangements (FSA) remains unchanged at $2,500.

- The foreign earned income exclusion rises to $99,200 for tax year 2014, up from $97,600, for 2013.

- The small employer health insurance credit provides that the maximum credit is phased out based on the employer’s number of full-time equivalent employees in excess of 10 and the employer’s average annual wages in excess of $25,400 for tax year 2014, up from $25,000 for 2013.

Details on these inflation adjustments and others not listed in this release can be found in Revenue Procedure 2013-35, which will be published in Internal Revenue Bulletin 2013-47 on Nov. 18, 2013.

Follow the IRS on New Media

Subscribe to IRS Newswire