Category Archives: General Information

ATTN: California Taxpayers – Head of Household

Newest update on the ‘Head of Household’ Audit Letters

Sacramento – The Franchise Tax Board (FTB) announced mailing more than 100,000 audit letters to taxpayers to verify their “Head of Household”(HOH) filing status on their 2012 state tax return. We are encouraging all of our clients – once the questionnaire is received – to call for an appointment to come in at (619) 589-8680.

Taxpayers who do not qualify will have their tax reassessed at either the single or married-filing-separate filing status. FTB assessed $26 million in additional tax to the nearly 38,000 taxpayers who used this status last year and did not meet its requirements. Continue reading

Want to cut your spouse’s tax cost of inherited IRA’s?

Use Estate Planning to protect your IRAs!

This post speaks to the IRA owner in planning the future, and how essential it is to plan your estate today. Put bluntly, “To get your estate situation the way you want it at death, you need to do your estate planning at the same time you build your asset portfolio. If you wait until you have built them, estate planning is much more difficult¹.” Continue reading

Retirement planning using IRAs

Using IRAs in tax planning during retirement

TAX: Because of the flexibility of IRA distributions, it’s easy to move income among years

By Richard Malamud, CPA, J.D., LL.M., and Tim Hilger, CPA

Those of us who are age 59½ and older and still working face some interesting decisions. After decades of hearing the mantra, “Defer, Defer, and then Defer” maybe it is time to change that to “Accelerate” — at least sometimes. It is the thing to do if you assume tax rates will not be going down and the future may bring us large capital gains or other income that could cause us to owe the new Medicare tax. Continue reading

Tax Benefits for Military

Special Tax Benefits for Armed Forces Personnel

IRS Summertime Tax Tip 2013-06, July 15, 2013

If you’re a member of the U.S. Armed Forces, the IRS wants you to know about the many tax benefits that may apply to you. Special tax rules apply to military members on active duty, including those serving in combat zones. These rules can help lower your federal taxes and make it easier to file your tax return. Continue reading

Personal Home? Tax Home? What’s the Difference?

Did you know that your personal home is not your tax home?

“Your tax deductions, tax strategies, and tax records hinge on the following federal income tax defined terms: Personal Home, Tax Home, Business Travel, Business Transportation.”¹

Do you know the definition and differences? Continue reading

Child Care Tax Specialists on Off-site Business Activity Hours

What Hours Can You Count When You Are Away From Home?

We’ve written about keeping track of your hours (http://childcaretaxspecialists.com/track-your-hours-even-when-children-arent-present/) but what about the hours you spend on business activities away from your home such as shopping for toys, picking up and dropping off children (if you offer that) or even attending seminars and workshops?

To read the whole post and download our (2) easy-to-use record keeping checklists click here.

Thinking of Selling Your Home? What About Taxes?

Will You Owe Taxes When You Sell Your Home?

Visit our Child Care Tax Specialists site and read more about what a family child care provider faces in the decision to sell their home by way of taxes. One tax you can probably avoid and another you cannot. This will give you the high points, but it is always best to speak with your tax preparer to get the latest on potential tax impacts.

Click here to read about the tax that you probably can avoid.

Attention California Business and Schedule C Taxpayers

Do you know about California’s City Business Tax Program?You may be getting a notice from your city. The FTB and cities are looking for revenue and the newest participants are Downey, Escondido, Fresno, Salinas, Santa Maria, and Tustin.

According to Spidell’s “…in June, cities were reminded to transmit 2012 business license information to the FTB on or before June 30.” For more information on the City Business Tax Program, click here.

“From this information, the FTB will send filing enforcement notices to self-employed individuals and other businesses that have failed to file a return.

Cities happily send this information in exchange for a list of businesses that have filed tax returns. The cities use this information to contact the business and assess fees, penalties, and interest for failing to file and pay for a city business license. The FTB sends the data to the cities in December of each year.”

Each city has different requirements as to who must have a license.

For a pdf of participating cities, click here

Source: Spidell’s July 2013 California Taxletter

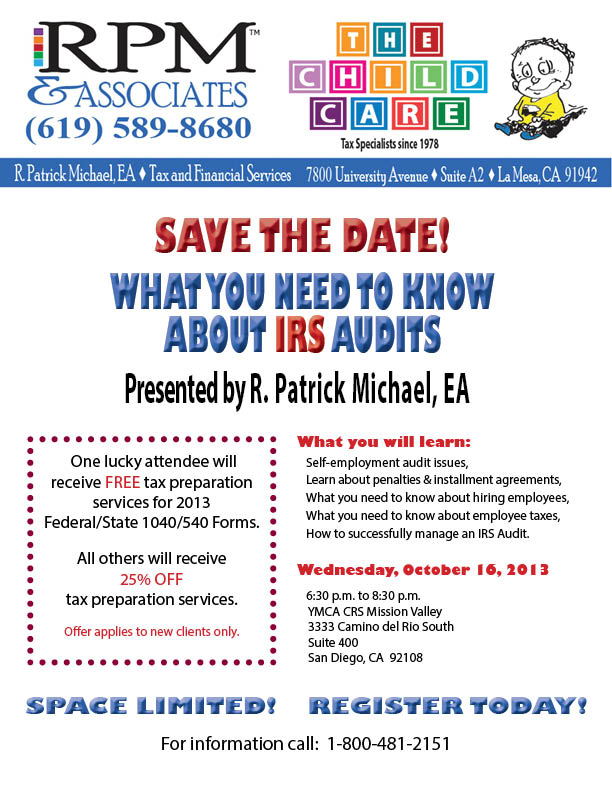

SAVE THE DATE! What You Need To Know About IRS Audits

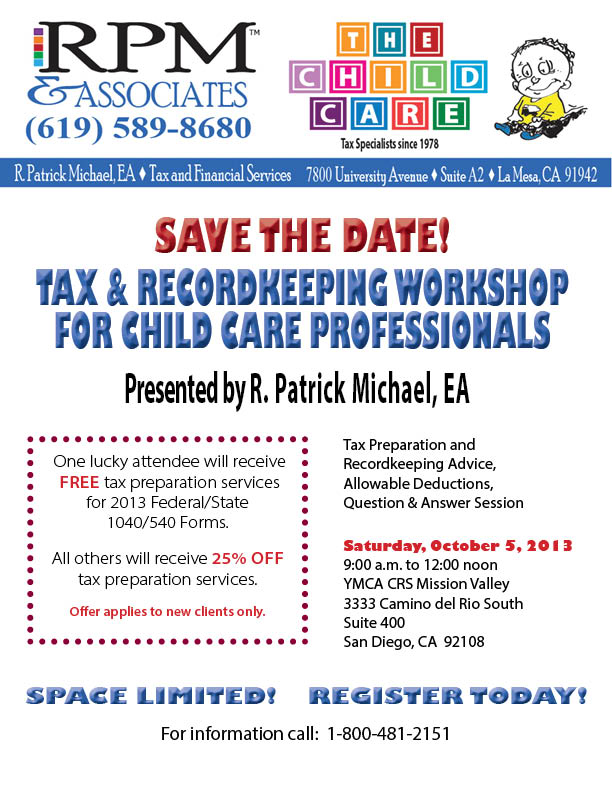

SAVE THE DATE! Tax and Recordkeeping Workshop

UPDATE: Fire Fee & State Responsibility Area Map Changes

Are You Affected by the State Responsibility Area Maps Update? Homeowners statewide will no longer receive refunds.

Back on May 28, we wrote that the Court ruled the $150 Fire Prevention Fee assessed by the California State Board of Equalization (BOE) against each structure in a “state responsibility area” is no longer deductible as a tax under IRC §164. Continue reading

UPDATE : California Offset Program Expands

California To Collect Debts From Out-Of-State Residents

The California offset program has been expanded to allow reciprocal agreements for California to collect debts from out-of-state residents. The Delinquent Taxpayer Accountability Act added Revenue and Taxation Code Section 19377.5, granting the Franchise Tax Board (FTB) the authority to enter into reciprocal agreements with other states to offset refunds to pay personal income tax (PIT) debts owed to the partner state. Continue reading

Important CA State and Federal Income Tax Dates

September 15, 2012

- 2013 third quarter estimated tax payments due for individuals and corporations

- State:

- Federal:

- 1040-ES (Instructions included)

October 15, 2013 Continue reading

Are you making a mistake with your 1099 Contractors?

Do you know what factors the IRS looks at in determining Independent Contractor Status?

Actually, the IRS does not look specifically at any one factor, but one factor can be enough to cause the IRS to take a closer look. They may determine that a worker is an employee and not a contractor. What does that mean for you? That means if they determine that your contractor was an employee – you could face unexpected payroll taxes and penalties. That’s why we’re giving you tools to make sure you know the difference, and that you are taking care of business. Continue reading

Are You Deducting All of Your Outdoor Expenses?

In Tom Copeland’s “Taking Care of Business”, he touches on what qualifies as outdoor deductions for child care provider businesses. Bottom line? Deduct all the expenses that are designated as “ordinary and necessary” to your business, especially if it is used 100% for your business. But what about those expenses that are used for business and personal purposes? They may be deductible, in part, so download our Time-Space Percentage Crib Sheet so you can keep track of those receipts! Download Crib Sheet here.

Tax Tips for June Graduates

Congratulations! You’ve made it!

School is done and you are ready to start mapping your career. Here are a few tips for you and your parents, to keep your taxes low. Continue reading

Bigger Income This Year? Call Me!

If you expect a jump in your income, we need to talk. Have you sold stock or property? Getting a big bonus (larger than in the past)? Had an unexpected windfall? I’ve used the word “jump” because if your income is usually high, we both know the numbers, and I make a point of keeping you up on the numbers. If, on the other hand, your numbers suddenly increase (larger than I normally see) then please let me know. Continue reading

New information return for some like-kind exchanges (06-17-13)

Beginning January 1, 2014, taxpayers who complete a like-kind exchange of California property for property located out-of-state will be required to file an information return with the FTB. (New R&TC §§18032, 24953 added by AB 92)

The information return must be filed for the year in which the exchange is completed and each subsequent year that the gain or loss is deferred. If the taxpayer fails to file an information return, and a required tax return is not filed, the FTB may estimate net income and assess tax, interest, and penalties.

For the full text of the bill, go to:

http://leginfo.ca.gov/pub/13-14/bill/asm/ab_0051-0100/ab_92_bill_20130614_enrolled.pdf