How the Tax Reform Act of 2014 Will Affect Your Small Business

How the Tax Reform Act of 2014 Will Affect Your Small Business

You may be holding your breath and wondering how tax reform will affect your small business.

The bill includes a renewal of Section 179 expensing. This tax advantage has typically been renewed every year with higher and higher thresholds, but on Jan. 1, the law reverted back to its original provision, which only allows $25,000 in the expensing of any new assets.

Purchases in excess of this amount must be depreciated over their useful lives. From 2010 to 2013, businesses were allowed a $500,000 threshold for Section 179 expensing. Proposed in the Tax Reform Act of 2014 will be a ceiling of $250,000 – levels enjoyed during 2008 and 2009.

The proposal does not allow for the renewal of bonus depreciation which also expired at the end of 2013. This allowed businesses to deduct 50% of the cost of all assets, above and beyond the Section 179 expensing.

In a statement, National Taxpayers Union Executive Vice President Pete Sepp said that the proposed reform aims to harmonize the top tax rate for S and C Corporations with qualified domestic income to 25%. He contends that because S Corporations are pass-through entities – the individual pays the tax on profit rather than the corporation – there will be an exclusion allowed to create an equivalent 25% tax. Qualified domestic income relates specifically to the manufacturing sector.

This change should encourage production and new jobs within our borders. “The proposal rightly aims to bring a measure of tax parity between ‘pass-through’ small business entities and traditional corporations, but how it hits that target must be thoroughly examined to ensure that job creators aren’t punished in the process,” Sepp said in a statement.

He also reiterated swift action on Capitol Hill will also be necessary. “Some tax-saving provisions for businesses will be gone several years before the final, beneficial 25% tax rate kicks in. Washington must avoid the appearance of clawing back many provisions in the short-term while pushing rate relief into the long-term.”

One tax element that hits many small business owners is the Alternative Minimum Tax which can be triggered when using net operating losses against current year income and when taking depreciation and Section 179 expensing.

On the other hand, the National Federation of Independent Business (NFIB) Vice President of Federal Public Policy Brad Close made the following statement in response to Camp’s proposed reform:

“NFIB has long advocated tax reform that achieves lower rates and a simpler code,” said Close. “While we appreciate Chairman Camp pursuing tax reform that lowers some rates, we are very concerned that this plan does not address the core issues that are important to all small businesses: simplifying the code, leveling the playing field for all businesses, and addressing both corporate and individual tax rates. We look forward to working with members of the Ways & Means Committee and Chairman Camp to achieve comprehensive tax reform that does not pick winners and losers based on size and type of business.”

The tax reform is nowhere near being carved in stone; after all, this is only the discussion draft, so we shall see.

Source: http://smallbusiness.foxbusiness.com/finance-accounting/2014/02/28/how-tax-reform-act-2014-will-affect-your-small-business/

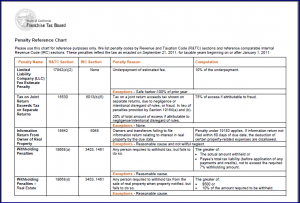

Many of our clients have come to us after having a bad tax preparation experience that resulted in penalties and interest. When we come across a reference document that we feel is valuable for the taxpayer – we promote it.

Many of our clients have come to us after having a bad tax preparation experience that resulted in penalties and interest. When we come across a reference document that we feel is valuable for the taxpayer – we promote it. Penalty reference chart (pdf)

Penalty reference chart (pdf)

Social Security, Treasury target taxpayers for their parents’ decades-old debts

Social Security, Treasury target taxpayers for their parents’ decades-old debts IR-2014-54, April 17, 2014

IR-2014-54, April 17, 2014

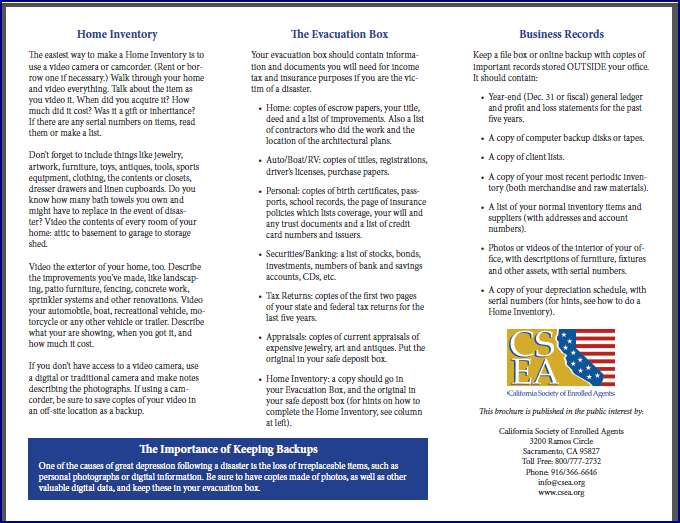

Now that April 15 has come and gone, everyone is writing about tax information, records to keep, and records you can discard. For some it’s just personal tax records. For others, it’s personal and business documents. However, before you go out and purchase electronic media to store records and receipts, please read our March 26 blog,

Now that April 15 has come and gone, everyone is writing about tax information, records to keep, and records you can discard. For some it’s just personal tax records. For others, it’s personal and business documents. However, before you go out and purchase electronic media to store records and receipts, please read our March 26 blog,

How the Tax Reform Act of 2014 Will Affect Your Small Business

How the Tax Reform Act of 2014 Will Affect Your Small Business United States Of Taxation 2014: Here Are The Best And Worst States For Consumption Taxes, Total Tax Burden

United States Of Taxation 2014: Here Are The Best And Worst States For Consumption Taxes, Total Tax Burden CHILD AND DEPENDENT CARE EXPENSES.

CHILD AND DEPENDENT CARE EXPENSES. Cost segregation deals with the depreciation of real estate enabling investors to dramatically increase the amount of depreciation they write off every year.

Cost segregation deals with the depreciation of real estate enabling investors to dramatically increase the amount of depreciation they write off every year. Organizations That Qualify To Receive Deductible Contributions

Organizations That Qualify To Receive Deductible Contributions Stopping refund fraud related to identity theft is a top priority for the tax agency. The IRS is focused on preventing, detecting and resolving identity theft cases as soon as possible.

Stopping refund fraud related to identity theft is a top priority for the tax agency. The IRS is focused on preventing, detecting and resolving identity theft cases as soon as possible. Seven significant new income tax law changes went into effect at the beginning of the year as a result of two pieces of legislation:

Seven significant new income tax law changes went into effect at the beginning of the year as a result of two pieces of legislation: