Many of our clients are in-home businesses. Entrepreneurs, start-ups, small businesses, child care providers, independent professionals, operators and so on. What makes US-TaxLaws.com different is we’re more than taxes. We’re about financial health. We help our clients make their tax dollars work for them. They’re going to have to pay taxes… the question is how much and why. Continue reading

Category Archives: Child Care Provider Tax Information

Mileage Rates Deductions for Business, Charity Services and Medical Travel

Mileage Deduction Rates

Mileage Deduction Rates

Studies funded by the IRS demonstrate it continues to be more expensive to drive a car. The standard mileage deductions (or reimbursement rates) appear in the following table:

Mileage Deduction Rates 2014

| Category | Rate (January to December) |

| Business Miles | 56.0 cents per mile |

| Charitable Services | 14.0 cents per mile |

| Medical Travel | 23.5 cents per mile |

Source: http://www.money-zine.com/financial-planning/tax-shelter/income-tax-changes-2

Looking Forward to 2015 Tax Benefits

In 2015, Various Tax Benefits Increase Due to Inflation Adjustments

In 2015, Various Tax Benefits Increase Due to Inflation Adjustments

For tax year 2015, the Internal Revenue Service announced annual inflation adjustments for more than 40 tax provisions, including the tax rate schedules, and other tax changes. Revenue Procedure 2014-61 provides details about these annual adjustments. Continue reading

Is the IRS having an accuracy problem?

According to Accounting Today the answer is yes. In their article “An IRS Error in Your Favor; businesses need help in fixing agency mistakes”, the IRS may be suffering from an accuracy problem.

According to Accounting Today the answer is yes. In their article “An IRS Error in Your Favor; businesses need help in fixing agency mistakes”, the IRS may be suffering from an accuracy problem.

But before I go any further, I’d like you to keep these numbers in mind that I’ll explain further down: 20, 10, 4, 6 = $81,578

What Accounting Today is alluding to is that because of the level of complexity of what the IRS is supposed to “check for”, and the sheer volume of returns processed, is exactly what sets the ball in motion for the IRS to make an error. They are examining returns for tax obligations and requirements, meeting the IRS rules concerning tax deductions, exceptions, return due dates, estimated installment amounts, and employment tax liability due dates, etc.. “There is a very real possibility that the IRS has miscalculated, resulting in many taxpayers unknowingly walking away from overpayments.” They also point out that start-ups and young companies “are at particular risk for error” because navigating can be especially challenging and they often fail to discover IRS errors or make their own mistakes. But the bad news doesn’t end there.

It isn’t just the IRS that has an accuracy problem. It’s tax preparers too. Seasonal front-window tax preparation services can be risky. A large segment of my business comes from child care providers. I specialize in their tax preparation. Just how well versed is a “seasonal tax preparer” to know their specific business, deductions and exceptions that need to be included for child care providers? I’ll wager not too many.

But remember the numbers I mentioned above… 20, 10, 4, 6 = $81,578? And what do they mean?

20 = The last 20 new clients that came into my office.

10 = Of the 20, 10 were Childcare Professionals.

4 = Of the 20, 4 were people who owned real estate rentals.

6 = Miscellaneous

$81,578 = Overpaid tax thru incorrect tax preparation.

The 20 returns were all incorrect preparation. Of the 20 only one was ‘self-prepared’. The others had used either a wholesale / front-window service or someone who claimed to know how to accurately prepare taxes. This is a much bigger problem than the IRS not calculating penalties correctly.

As practitioners, one of the first *benefits* we bring a client is in examining and scrubbing their previous returns. Depending on the history, it can be one to three years. It can be more if history warrants it. If there has been an error – we will find it.

Today you cannot be too careful. You are in a need to know capacity – and you need to have trust in the person who is doing your taxes. Always err on the side of caution. There is no way a wholesale /front window tax preparation service and its preparers that operate “seasonally” is going to be available if you get a letter from the IRS. Why risk it?

When we meet with a prospective client, what I want them to know is that 85% of our clients are from referrals. Of those 85% – more than 50% are “lifetime clients” (meaning more than 15-20 years) and now we have THEIR children and relatives as clients; generational referred clients.

End Point: Keep that in mind when selecting someone who is going to prepare your taxes. You want consistency, trustworthiness, experience and knowledge – and someone you can reach if you are contacted by the IRS. You want an Enrolled Agent.

Source: http://www.accountingtoday.com/ato_issues/28_10/An-IRS-error-in-your-favor-72213-1.html

When Should Child Care Professionals Raise Their Rates?

Does talking about rate increases with your client make you uncomfortable?

You’re not alone. Many child care providers feel awkward talking about rates and fee increases with their clients. However, just as many of your clients get annual reviews and increases in their job-related compensation, it isn’t unreasonable for you to need to adjust your rates if only to meet inflation.

You’re not alone. Many child care providers feel awkward talking about rates and fee increases with their clients. However, just as many of your clients get annual reviews and increases in their job-related compensation, it isn’t unreasonable for you to need to adjust your rates if only to meet inflation.

Read HOW and WHEN TO RAISE YOUR RATES

IRS Forms and Schedules You’ll Need

On Your Mark… Get Set ….. Go!

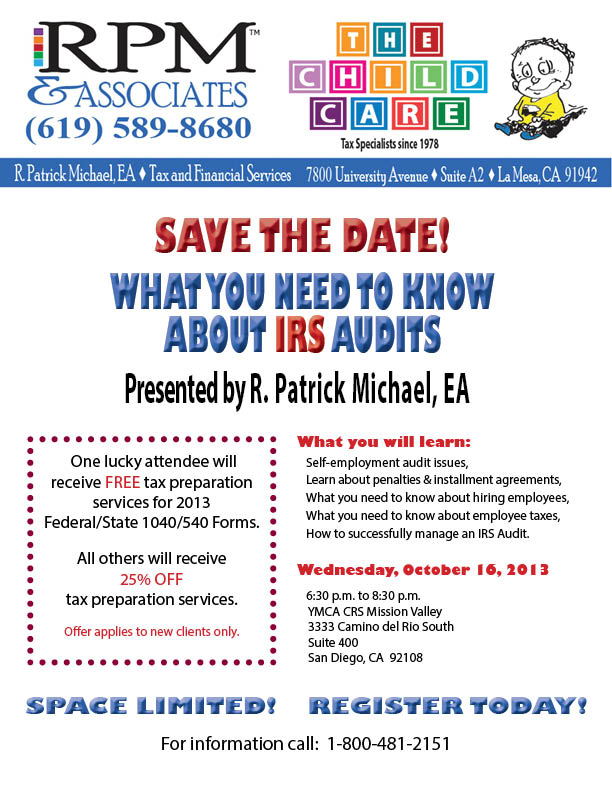

GETTING NERVOUS? CALL ME! 619-589-8680

The IRS has recently announced that they will not start processing 2013 tax returns until January 31, 2014. This means there is no reason to efile or mail in your tax forms before then.

Before sending in your tax forms, here’s a review of the key business tax forms you must file and the order you should be filling them out. Continue reading →

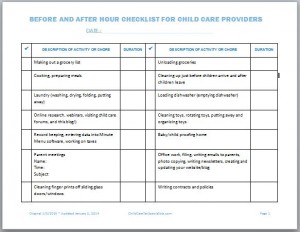

Track your hours BEFORE and AFTER children are present

WE KNOW PROVIDING CHILD CARE IS NOT A 9-5 JOB!

Your job starts well before children are present and goes on well after the last child has left your care. Unfortunately, it is exactly for that reason that so much of your time never gets counted, as it should.

Your job starts well before children are present and goes on well after the last child has left your care. Unfortunately, it is exactly for that reason that so much of your time never gets counted, as it should.

Want the checklist? Read the post HERE.

For Child Care Providers: How To Calculate Time-Percent

What do we mean by Time Percent?

This percent is determined by adding up the number of hours you are using your home for business purposes and dividing this number by the total number of hours in the year (8,760). There are two types of hours to include: hours when day care children are present in your home and hours when children are not present but you are engaged in business activities.

For more information, read full post on How To calculate Time-Percentage

Mileage Deductions

For 2013 you get 56.5¢ for each business mile (keep your logs daily) . While employees can’t deduct driving to work, look at visits to clients, extra meetings, errands or shopping for supplies. Business owners – especially child care providers – have the same and more. To learn more, click here.

Audit Alert #2 – Letter from the IRS?

What to do when you get a letter from the IRS.

You’ve gotten a letter from the IRS. Don’t panic.

You’ve gotten a letter from the IRS. Don’t panic.

Pat Michael, EA, discusses what you may be facing, and the actions you will need to take. Read the full post here.

Audit Alert #1 – Trip Wire – Mileage Logs

Wondering why you got a letter from the IRS? Could it be your mileage log? The IRS Is a stickler for details when it comes to mileage logs. Did you make sure that your mileage log reflected the day-to-day use and associated expenses for your vehicle(s)? Read our blog on “What is the most common trip wire to trigger an audit?”

How Will The Affordable Care Act Affect Child Care Providers?

Child Care Tax Specialists takes a look at the comprehensive landmark changes in the health care law and its impact. Read the full post here http://childcaretaxspecialists.com/how-will-the-affordable-care-act-impact-child-care-professionals/

May I Refuse to Care for a Child Who is Not Immunized?

A parent who wants to enroll in your family child care program tells you she refuses to immunize her child. What do you do?

Child Care Tax Specialists takes a look at the issues surrounding refusing a child into a Child Care program. It is complicated, and there are a lot of exemptions. Child Care Professionals have to know how to handle this kind of situation.

Read the full post at http://childcaretaxspecialists.com/may-i-refuse-to-care-for-a-child-who-is-not-immunized/

Affordable Care Act Provisions for Small Employers, Beginning October 1, 2013

Some of the provisions of the Affordable Care Act, or health care law, apply only to small employers, generally those with fewer than 50 full-time employees or equivalents.

If you have fewer than 50 employees, but are a member of an ownership group with 50 or more full-time equivalent employees, you are subject to the rules for large employers.

Coverage

- Beginning Oct. 1, 2013, if you have 50 or fewer employees, you can purchase affordable insurance through the Small Business Health Options Program (SHOP).

- To learn more about how the Affordable Care Act may affect your business, visit HealthCare.gov.

Reporting

- Effective for calendar year 2015, if you provide self-insured health coverage to your employees, you must file an annual return reporting certain information for each employee you cover. This rule is optional for 2014. Learn more.

- Beginning Jan. 1, 2013, you must withhold and report an additional 0.9 percent on employee wages or compensation that exceed $200,000. Learn more.

- You may be required to report the value of the health insurance coverage you provided to each employee on his or her Form W-2.

Payments & Credits

- You may be eligible for the Small Business Health Care Tax Credit if you cover at least 50 percent of your full-time employee’s premium costs and you have fewer than 25 full-time equivalent employees with average annual wages of less than $50,000.

- If you self-insure, you may be required to pay a fee to help fund the Patient- Centered Outcomes Research Trust Fund.

IT IS IMPORTANT TO CHOOSE A TAX PROFESSIONAL, SUCH AS AN ENROLLED AGENT, WHO KEEPS UP WITH THE RULES AND REGULATIONS AND USES THIS EXPERTISE TO DO THE BEST JOB POSSIBLE FOR EVERY TAXPAYER.

R. Patrick Michael, EA, continues to provide tax preparation and financial consultation services since 1978. Pat can be reached at 619-589-8680

Employer-Provided Health Coverage Informational Reporting Requirements: Questions and Answers

IRS Q&A Affordable Care Act Reporting Requirements

The Affordable Care Act requires employers to report the cost of coverage under an employer-sponsored group health plan. To allow employers more time to update their payroll systems, Continue reading

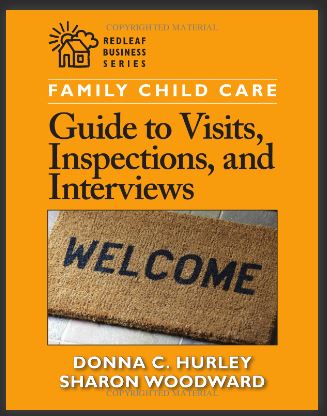

Family Child Care Guide to Visits, Inspections and Interviews

Redleaf Press has a new “how to” guide by Donna C. Hurley and Sharon Woodward.

Redleaf Press has a new “how to” guide by Donna C. Hurley and Sharon Woodward.

“Case studies featuring more than twenty common challenges that can occur during visits and skill-based solutions and successful strategies you can use to prepare for those situations

Checklists and self-examination activities to help you welcome and connect with potential families, specialists, and inspectors in positive ways

Support, guidance, and techniques to enhance your program”

Softbound, 144 pgs.

Read the full post at http://childcaretaxspecialists.com/guide-to-visits-inspections-and-interviews/

Child Care Tax Specialists on Off-site Business Activity Hours

What Hours Can You Count When You Are Away From Home?

We’ve written about keeping track of your hours (http://childcaretaxspecialists.com/track-your-hours-even-when-children-arent-present/) but what about the hours you spend on business activities away from your home such as shopping for toys, picking up and dropping off children (if you offer that) or even attending seminars and workshops?

To read the whole post and download our (2) easy-to-use record keeping checklists click here.

Thinking of Selling Your Home? What About Taxes?

Will You Owe Taxes When You Sell Your Home?

Visit our Child Care Tax Specialists site and read more about what a family child care provider faces in the decision to sell their home by way of taxes. One tax you can probably avoid and another you cannot. This will give you the high points, but it is always best to speak with your tax preparer to get the latest on potential tax impacts.