More than 1 million Californians did not file a 2012 state income tax return!

More than 1 million Californians did not file a 2012 state income tax return!

Sacramento – Last year, the FTB collected more than $727 million dollars through their diligent campaign to find people who did not file!

The FTB receives more than 400 million income records from bank, employers, state departments, the IRS and other sources.

This program is designed to find wage earners and self-employed who did not file – it also tracks down other nonfilers through sources such as occupational licenses and mortgage interest payments.

If contacted, you have 30 days to file or to show why one isn’t due. For those who do not respond, the FTB will issue a tax assessment using income records to estimate the amount of state tax due. It will include interest, fees and penalties. If you get a letter, contact us immediately. Do not wait. Do not hesitate. Call us at 619-589-8680.

The FTB administers two of CA’s major tax programs – Personal Income Tax and Corporation Tax. They take their job seriously and are responsible for collecting more than 65% of California’s general fund. For more information visit taxes.ca.gov.

Tax information is not tax advice. Always speak with your tax professional before making decisions. If you need to speak with a tax professional, give us a call today at 619-589-868.

Whatever the name, taxes can be painful and the new tax is known by a few: the Affordable Care Act tax, the Obamacare tax, the Net Investment Income Tax (NIIT), or Medicare Tax. Most media (and even the President) is using the name “Obamacare Tax”, so we will use that name for this writing. For a full Q&A on the new tax, please see our

Whatever the name, taxes can be painful and the new tax is known by a few: the Affordable Care Act tax, the Obamacare tax, the Net Investment Income Tax (NIIT), or Medicare Tax. Most media (and even the President) is using the name “Obamacare Tax”, so we will use that name for this writing. For a full Q&A on the new tax, please see our

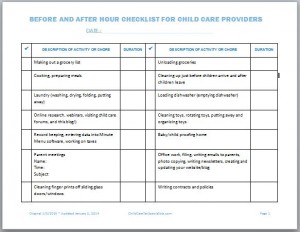

Your job starts well before children are present and goes on well after the last child has left your care. Unfortunately, it is exactly for that reason that so much of your time never gets counted, as it should.

Your job starts well before children are present and goes on well after the last child has left your care. Unfortunately, it is exactly for that reason that so much of your time never gets counted, as it should.

Sacramento –An Elk Grove Woman was sentenced to 3 years in state prison for grand theft with a white collar crime enhancement, forgery, and filing a false state income tax return, the Franchise Tax Board (FTB) announced.

Sacramento –An Elk Grove Woman was sentenced to 3 years in state prison for grand theft with a white collar crime enhancement, forgery, and filing a false state income tax return, the Franchise Tax Board (FTB) announced. The Affordable Care Act requires employers to report the cost of coverage under an employer-sponsored group health plan on an employee’s Form W-2, Wage and Tax Statement, in Box 12, using Code DD. Many employers are eligible for transition relief for tax-year 2012 and beyond, until the IRS issues final guidance for this reporting requirement.

The Affordable Care Act requires employers to report the cost of coverage under an employer-sponsored group health plan on an employee’s Form W-2, Wage and Tax Statement, in Box 12, using Code DD. Many employers are eligible for transition relief for tax-year 2012 and beyond, until the IRS issues final guidance for this reporting requirement. Small Business Health Care Tax Credit

Small Business Health Care Tax Credit

The budget deal that Congress and President Obama struck at the beginning of the year to avoid the fiscal cliff resulted in seven tax increases. If you throw in the six tax hikes that are part of Obamacare, that means there are 13 new taxes that may have hit you in 2013.

The budget deal that Congress and President Obama struck at the beginning of the year to avoid the fiscal cliff resulted in seven tax increases. If you throw in the six tax hikes that are part of Obamacare, that means there are 13 new taxes that may have hit you in 2013. Who Must Issue 1099’s?

Who Must Issue 1099’s?  The IRS receives copy of all your tax-related forms. They are compared to your return. You can’t miss any of these documents. Watch the mail.

The IRS receives copy of all your tax-related forms. They are compared to your return. You can’t miss any of these documents. Watch the mail.