Reporting Employer Provided Health Coverage in Form W-2

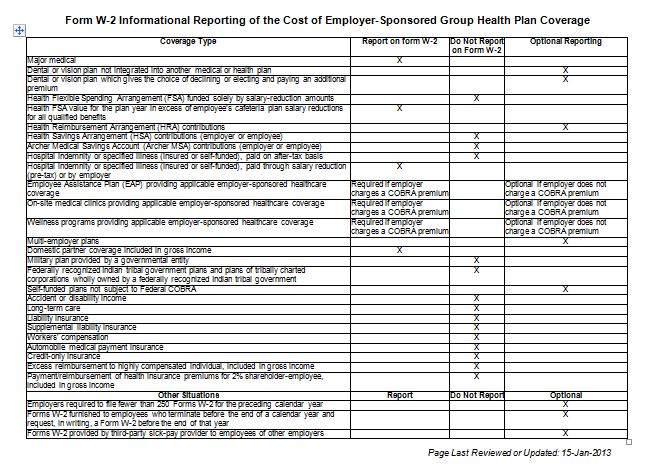

The Affordable Care Act requires employers to report the cost of coverage under an employer-sponsored group health plan on an employee’s Form W-2, Wage and Tax Statement, in Box 12, using Code DD. Many employers are eligible for transition relief for tax-year 2012 and beyond, until the IRS issues final guidance for this reporting requirement.

The Affordable Care Act requires employers to report the cost of coverage under an employer-sponsored group health plan on an employee’s Form W-2, Wage and Tax Statement, in Box 12, using Code DD. Many employers are eligible for transition relief for tax-year 2012 and beyond, until the IRS issues final guidance for this reporting requirement.

The amount reported does not affect tax liability, as the value of the employer excludable contribution to health coverage continues to be excludable from an employee’s income, and it is not taxable. This reporting is for informational purposes only, to show employees the value of their health care benefits.

More information about the reporting can be found on Form W-2 Reporting of Employer-Sponsored Health Coverage.

Source: http://www.irs.gov/uac/Affordable-Care-Act-Tax-Provisions

Image Credit: ClipArt

The Affordable Care Act requires employers to report the cost of coverage under an employer-sponsored group health plan on an employee’s Form W-2, Wage and Tax Statement, in Box 12, using Code DD. Many employers are eligible for transition relief for tax-year 2012 and beyond, until the IRS issues final guidance for this reporting requirement.

The Affordable Care Act requires employers to report the cost of coverage under an employer-sponsored group health plan on an employee’s Form W-2, Wage and Tax Statement, in Box 12, using Code DD. Many employers are eligible for transition relief for tax-year 2012 and beyond, until the IRS issues final guidance for this reporting requirement. The IRS receives copy of all your tax-related forms. They are compared to your return. You can’t miss any of these documents. Watch the mail.

The IRS receives copy of all your tax-related forms. They are compared to your return. You can’t miss any of these documents. Watch the mail.