WHO WANTS A FREE TAX TIP?

WHO WANTS A FREE TAX TIP?

If you haven’t filed yet, the IRS has these 10 tax-time tips to help you. The April 18 deadline to file your federal tax return is less than two weeks away. Don’t wait until the last minute.

1.Gather your records. Make sure you have all your tax records. This includes receipts, canceled checks and other records that support income, deductions or tax credits that you claim. If you purchased health insurance through the Marketplace, you will need the information in Form 1095-A to file.

2.Report all your income. You will need to report your income from all of your Forms W-2, Wage and Tax Statements, Forms 1099 and any other income – even if you don’t receive a statement – when you file your tax return.

3.Try IRS Free File. Free File is available only on IRS.gov. If you made $62,000 or less, you can use free name-brand tax software to file your federal tax return. If you earned more, you can use Free File Fillable Forms, an electronic version of IRS paper forms. If you need more time to file, you can also use IRS Free File to get an automatic six-month extension to file your taxes. Remember, an extension to file your tax return is not an extension to pay taxes you owe, which are due April 18.

4.Try IRS e-file. Electronic filing is the best way to file a tax return. It’s accurate, safe and easy. If you owe taxes, you have the option to e-file early and pay by April 18 to avoid penalties and interest.

5.Use Direct Deposit. The fastest and safest way to get your refund is to combine e-file with direct deposit. The IRS issues more than nine out of 10 refunds in less than 21 days.

6.Visit IRS.gov. IRS.gov is a great place to get what you need to file your tax return. Click on the “Filing” icon for links to filing tips, answers to frequently asked questions and IRS forms and publications. Get them all at any time. The IRS Services Guide outlines the many ways to get help on IRS.gov.

7.Use IRS online tools. The IRS has many online tools on IRS.gov to help you file. For instance, the Interactive Tax Assistant tool provides answers to many of your tax questions. The tool gives the same answers that an IRS representative would give over the phone. If you want to find a tax preparer with the qualifications and credentials that you prefer, use the IRS Directory of Federal Tax Return Preparers. IRS tools are free and easy to use. They are also available 24/7.

8.Weigh your filing options. You have different options for filing your tax return. You can prepare it yourself or go to a tax preparer. You may be eligible for free help at a Volunteer Income Tax Assistance or Tax Counseling for the Elderly site.

9.Check out number 17. IRS Publication 17, Your Federal Income Tax, is a complete tax resource that you can read on IRS.gov. It’s also available as an eBook. It can help you with many tax questions, such as whether you need to file a tax return, or how to choose your filing status.

10.Review your return. Mistakes slow down your tax refund. If you file a paper return, be sure to check all Social Security numbers. That’s one of the most common errors. Remember that IRS e-file is the most accurate way to file.

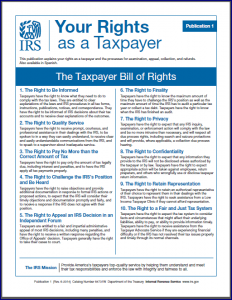

Each and every taxpayer has a set of fundamental rights they should be aware of when dealing with the IRS. These are your Taxpayer Bill of Rights. Explore your rights and our obligations to protect them on IRS.gov.

Millennials Are Planning to Save Tax Refund

Millennials Are Planning to Save Tax Refund Mileage Deduction Rates

Mileage Deduction Rates Have you set up your appointment to have taxes done?

Have you set up your appointment to have taxes done? In 2015, Various Tax Benefits Increase Due to Inflation Adjustments

In 2015, Various Tax Benefits Increase Due to Inflation Adjustments

According to Accounting Today the answer is yes. In their article “An IRS Error in Your Favor; businesses need help in fixing agency mistakes”, the IRS may be suffering from an accuracy problem.

According to Accounting Today the answer is yes. In their article “An IRS Error in Your Favor; businesses need help in fixing agency mistakes”, the IRS may be suffering from an accuracy problem.

payer Bill of Rights

payer Bill of Rights  What would happen if the IRS re-classified your business as a hobby?

What would happen if the IRS re-classified your business as a hobby?

How the Tax Reform Act of 2014 Will Affect Your Small Business

How the Tax Reform Act of 2014 Will Affect Your Small Business United States Of Taxation 2014: Here Are The Best And Worst States For Consumption Taxes, Total Tax Burden

United States Of Taxation 2014: Here Are The Best And Worst States For Consumption Taxes, Total Tax Burden CHILD AND DEPENDENT CARE EXPENSES.

CHILD AND DEPENDENT CARE EXPENSES. Cost segregation deals with the depreciation of real estate enabling investors to dramatically increase the amount of depreciation they write off every year.

Cost segregation deals with the depreciation of real estate enabling investors to dramatically increase the amount of depreciation they write off every year. Organizations That Qualify To Receive Deductible Contributions

Organizations That Qualify To Receive Deductible Contributions