Here is a link to the complete IRS FAQ. that make it clear that same-sex married couples must file extended 2012 returns by September 15, 2013, to file as single.

For tax year 2013 and going forward, same-sex spouses generally must file using a married filing separately or jointly filing status.

For tax year 2012 and all prior years, same-sex spouses who file an original tax return on or after Sept. 16, 2013 (the effective date of Rev. Rul. 2013-17), generally must file using a married filing separately or jointly filing status.

For tax year 2012, same-sex spouses who filed their tax return before Sept. 16, 2013, may choose (but are not required) to amend their federal tax returns to file using married filing separately or jointly filing status.

For tax years 2011 and earlier, same-sex spouses who filed their tax returns timely may choose (but are not required) to amend their federal tax returns to file using married filing separately or jointly filing status provided the period of limitations for amending the return has not expired.

A taxpayer generally may file a claim for refund for three years from the date the return was filed or two years from the date date the tax was paid, whichever is later.

For information on filing an amended return, go to Tax Topic 308, Amended Returns, at http://www.irs.gov/taxtopics/tc308.html.the tax was paid, whichever is later.

For information on filing an amended return, go to Tax Topic 308, Amended Returns, at http://www.irs.gov/taxtopics/tc308.html.

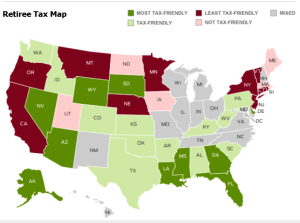

Want to know where is the best place to live in retirement?

Want to know where is the best place to live in retirement?