Tag Archives: 2014 Tax Changes

Reduce Your Taxes with Miscellaneous Deductions

IRS Summertime Tax Tip 2013-15, August 5, 2013

![]() If you itemize deductions on your tax return, you may be able to deduct certain miscellaneous expenses. You may benefit from this because a tax deduction normally reduces your federal income tax. Here are some things you should know about miscellaneous deductions:

If you itemize deductions on your tax return, you may be able to deduct certain miscellaneous expenses. You may benefit from this because a tax deduction normally reduces your federal income tax. Here are some things you should know about miscellaneous deductions:

Deductions Subject to the Two Percent Limit. You can deduct most miscellaneous expenses only if they exceed two percent of your adjusted gross income. These include expenses such as: Continue reading

Deadline for some same-sex marrieds is September 15, 2013

The IRS has released FAQs clarifying the Revenue Ruling 2013-17 .

Here is a link to the complete IRS FAQ. that make it clear that same-sex married couples must file extended 2012 returns by September 15, 2013, to file as single.

For tax year 2013 and going forward, same-sex spouses generally must file using a married filing separately or jointly filing status.

For tax year 2012 and all prior years, same-sex spouses who file an original tax return on or after Sept. 16, 2013 (the effective date of Rev. Rul. 2013-17), generally must file using a married filing separately or jointly filing status.

For tax year 2012, same-sex spouses who filed their tax return before Sept. 16, 2013, may choose (but are not required) to amend their federal tax returns to file using married filing separately or jointly filing status.

For tax years 2011 and earlier, same-sex spouses who filed their tax returns timely may choose (but are not required) to amend their federal tax returns to file using married filing separately or jointly filing status provided the period of limitations for amending the return has not expired.

A taxpayer generally may file a claim for refund for three years from the date the return was filed or two years from the date date the tax was paid, whichever is later.

For information on filing an amended return, go to Tax Topic 308, Amended Returns, at http://www.irs.gov/taxtopics/tc308.html.the tax was paid, whichever is later.

For information on filing an amended return, go to Tax Topic 308, Amended Returns, at http://www.irs.gov/taxtopics/tc308.html.

Affordable Care Act Tax Provision for Large Employers – Beginning October 1, 2013

In 2015 large employers will have annual reporting responsibilities concerning whether and what health insurance they offered to their full-time employees.

Some of the provisions of the Affordable Care Act, or health care law, apply only to large employers, generally those with 50 or more full-time equivalent employees.

Coverage

- Beginning Oct. 1, 2013, if you have 50 or fewer employees, you can purchase affordable insurance through the Small Business Health Options Program (SHOP).

- To learn more about market reforms and various plan requirements, visit HealthCare.gov Reporting

Reporting

- Effective for calendar year 2015, you must file an annual return reporting whether and what health insurance you offered your employees. This rule is optional for 2014. Learn more.

- Effective for calendar year 2015, if you provide self-insured health coverage to your employees, you must file an annual return reporting certain information for each employee you cover.This rule is optional for 2014. Learn more.

- Beginning Jan. 1, 2013, you must withhold and report an additional 0.9 percent on employee wages or compensation that exceed $200,000. Learn more.

- You may be required to report the value of the health insurance coverage you provided to each employee on his or her Form W-2.

Payment & Provisions

- Effective for calendar year 2015, you may have to make a payment if you do not offer adequate, affordable coverage to your full-time employees, and one or more of those employees get a Premium Tax Credit. Learn more.

- If you self-insure, you may be required to pay a fee to help fund the Patient- Centered Outcomes Research Trust Fund

Affordable Care Act Provisions for Small Employers, Beginning October 1, 2013

Some of the provisions of the Affordable Care Act, or health care law, apply only to small employers, generally those with fewer than 50 full-time employees or equivalents.

If you have fewer than 50 employees, but are a member of an ownership group with 50 or more full-time equivalent employees, you are subject to the rules for large employers.

Coverage

- Beginning Oct. 1, 2013, if you have 50 or fewer employees, you can purchase affordable insurance through the Small Business Health Options Program (SHOP).

- To learn more about how the Affordable Care Act may affect your business, visit HealthCare.gov.

Reporting

- Effective for calendar year 2015, if you provide self-insured health coverage to your employees, you must file an annual return reporting certain information for each employee you cover. This rule is optional for 2014. Learn more.

- Beginning Jan. 1, 2013, you must withhold and report an additional 0.9 percent on employee wages or compensation that exceed $200,000. Learn more.

- You may be required to report the value of the health insurance coverage you provided to each employee on his or her Form W-2.

Payments & Credits

- You may be eligible for the Small Business Health Care Tax Credit if you cover at least 50 percent of your full-time employee’s premium costs and you have fewer than 25 full-time equivalent employees with average annual wages of less than $50,000.

- If you self-insure, you may be required to pay a fee to help fund the Patient- Centered Outcomes Research Trust Fund.

IT IS IMPORTANT TO CHOOSE A TAX PROFESSIONAL, SUCH AS AN ENROLLED AGENT, WHO KEEPS UP WITH THE RULES AND REGULATIONS AND USES THIS EXPERTISE TO DO THE BEST JOB POSSIBLE FOR EVERY TAXPAYER.

R. Patrick Michael, EA, continues to provide tax preparation and financial consultation services since 1978. Pat can be reached at 619-589-8680

IRS Invites Public Comment on Recommendations for 2013-2014 Guidance Priority List

The Dept. of Treasury and IRS invite public comment on recommendations for items that should be included on the 2013-2014 Guidance Priority List.

The Treasury Department’s Office of Tax Policy and the Service use the Guidance Priority List each year to identify and prioritize the tax issues that should be addressed through regulations, revenue rulings, revenue procedures, notices, and other published administrative guidance. Continue reading

IRS revises Guidance on W-2 reporting of Group Health Insurance Costs

Employers need to understand the latest IRS pertaining to the ACA, what their obligations are and have systems in place for tracking and calculating reportable costs. For many, the reporting requirement became effective for the 2012 tax year— but for qualifying small employers (filing less than 250 W-2’s) many of these obligations will take effect for the 2013 tax year. Continue reading

IRS Offers Businesses Voluntary Classification Settlement Program

Back in July we wrote about businesses that have treated workers as 1099 contractors (“Are you making a mistake with your 1099 Contractors?”), and pointed out that if the IRS determines that your workers are not 1099 contractors, but actually “employees”, you may be faced with unexpected payroll taxes and penalties. The IRS has created the VCSP program for businesses that want to voluntarily reclassify their workers as employees. Continue reading

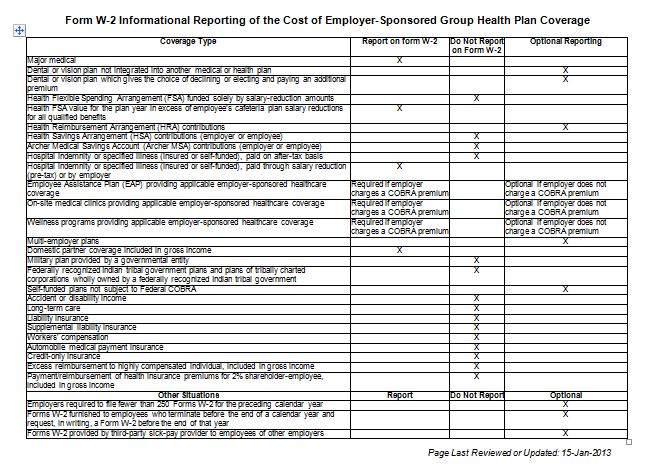

More Information on W-2 Reporting Requirements for Employers

Not sure what to report on W-2, optional or mandatory?

Our table is based on IRS Notice 2012-9, which, until further guidance, contains the requirements for tax-year 2012 and beyond. Items listed as “optional” are designated as such based on transition relief provided by Notice 2012-9, and their “optional” status may be changed by future guidance. However, any such change will not be applicable until the tax year beginning at least six months after the date of issuance of such guidance. Continue reading

Employer-Provided Health Coverage Informational Reporting Requirements: Questions and Answers

IRS Q&A Affordable Care Act Reporting Requirements

The Affordable Care Act requires employers to report the cost of coverage under an employer-sponsored group health plan. To allow employers more time to update their payroll systems, Continue reading

Informational Reporting of the Cost of Employer-Sponsored Group Health Care Plan Coverage

Not sure what to report on W-2, optional or mandatory?

This table is based on IRS Notice 2012-9, which, until further guidance, contains the requirements for tax-year 2012 and beyond. Items listed as “optional” are designated as such based on transition relief provided by Notice 2012-9, and their “optional” status may be changed by future guidance. However, any such change will not be applicable until the tax year beginning at least six months after the date of issuance of such guidance.

This table was created at the suggestion of and in collaboration with the IRS’ Information Reporting Program Advisory Committee (IRPAC). IRPAC’s members are representatives of industries responsible for providing information returns, such as Form W-2, to the IRS. IRPAC works with IRS to improve the information reporting process.

2013 Tax Changes to Remember on the Road to 2014

2013 contribution limits increased for some of the more popular retirement vehicles. IRS-2012-77, October 18, 2012:

- The elective deferral (contribution) limit for employees who participate in 401(k), 403(b), most 457 plans and the federal government’s “Thrift Savings Plan” increased $500.00.

- The catch-up contribution for age 50+ employees and who participate in 401(k), 403(b), most 457 plans and the federal government’s “Thrift Savings Plan” remains unchanged at $5,500.00. Continue reading