Our services include, but are not limited to:

Audit Representation, Bookkeeping, Business Support Services, Business Tax Preparation, Business Tax Planning, Corporate Compliance, Corporate Tax Preparation, Estate Planning, Incorporation-Choice of Entity, Partnership Tax Preparation, Payroll, Personal Tax Preparation, Retirement Planning, Retirement Tax Planning,

Trusts & Wills

US-TaxLaws Blog

How we work with you

Tax Interview Checklist

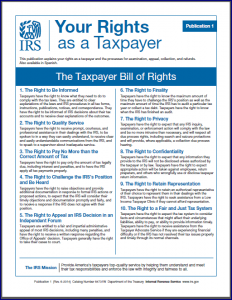

On June 10, 2014, the IRS adopted a Taxpayer Bill of Rights (TBOR), a list of 10 rights that the National Taxpayer Advocate has long recommended to help taxpayers and IRS employees alike gain a better understanding of the dozens of discrete taxpayer rights scattered throughout the multi-million word Internal Revenue Code.

A taxpayer survey conducted for the Taxpayer Advocate Service (TAS) in 2012 found that fewer than half of U.S. taxpayers believe they have rights before the IRS, and only 11 percent said they know what those rights are.

“Taxpayer knowledge and education is the best taxpayer protection there is,” the report says. “A comprehensive public outreach campaign is crucial to overcome taxpayers’ lack of knowledge about their rights and inform them that the IRS has adopted a TBOR. These initiatives will require a variety of communication plans and tools, all with the goal of making taxpayer rights a part of every IRS communication with the taxpayer.”

Source: National Taxpayer Advocate Nina E. Olson, IR-2014-78, National Taxpayer Advocate Mid-Year Report

Huge tax increases and changes that will affect your tax return

We need to talk — soon. There are huge tax increases and changes that will affect your tax return. There was a big tax change on New Year’s Day this year, along with Obamacare tax increases and penalties if your withholding and estimated payments aren’t sufficient.

I know you have read many articles and heard reporters talk about the new changes and you may think you have a handle on how these tax events affect you. But each situation is different and I feel strongly that you should have a look at your unique situation.

Changes that will affect your tax situation include:

- New 3.8% surtax on investment income;

- New 0.9% Medicare tax on earned income;

- Phaseouts of itemized deductions and exemption credits based on income;

- Loss of certain education-related benefits;

- Change in taxation of short sales and foreclosures of personal residences;

- Insurance changes and forms to be filed if you are participating in the state insurance exchange;

- Penalties for employers with more than 50 employees that don’t provide health insurance; and

- Other items too numerous to list here.

Please call my office and schedule an appointment to review your current tax situation. I look forward to providing you with a roadmap to paying the least amount of tax legally owed and avoiding unnecessary penalties.

Image credit: NAEA