Statewide Median Income Up In 2012

Statewide Median Income Up In 2012

California’s median income for all 2012 individual tax returns was $35,910, an increase of 3.5 percent over 2011’s median income amount. For joint returns, the statewide median income was $70,938, an increase of 4.1 percent over 2011.

“Median income” represents the income reported by a typical California individual or couple and the point where one half of the tax returns median income is above and one half is below the midpoint of the range of values.

California taxpayers filed nearly 16 million 2012 state income tax returns, reporting almost $1.5 trillion of adjusted gross income. This figure is an increase of 27.7 percent from the tax year 2011’s figure of $1.1 trillion. Adjusted gross income is a tax term that means the total income increased or reduced by specific adjustments, before taking the standard or itemized deduction.

Over the past 40 years, the Bay Area counties of Marin, San Mateo, and Santa Clara have consistently reported the highest median incomes. Marin County still has the highest median income for joint tax returns, reporting $127,471, an increase of 6.1 percent over 2011.

Top 10 Counties Reporting Highest Joint Tax Return Median Income

| Rank |

County |

Median Income (Joint Returns) |

| 1 |

Marin |

$127,471 |

| 2 |

San Mateo |

$109,827 |

| 3 |

Santa Clara |

$109, 309 |

| 4 |

Alameda |

$93,557 |

| 5 |

Contra Costa |

$93,367 |

| 6 |

San Francisco |

$87,446 |

| 7 |

Placer |

$83,869 |

| 8 |

El Dorado |

$82,706 |

| 9 |

Orange |

$78,108 |

| 10 |

Ventura |

$77,340 |

Los Angeles County taxpayers filed more than a quarter (26.6 percent) of all 2012 income tax returns in California. Los Angeles County reported median incomes of $31,144 for all individual tax returns, and $60,939 for joint tax returns, ranking 36 and 25 respectively.

The largest percentage gain in median income for all counties was 6.0 percent, reported in Contra Costa County. For joint-filed tax returns, the largest increase was in San Francisco County with a 7.7 percent increase.

Source: https://www.ftb.ca.gov/professionals/taxnews/2014/March/Article_5.shtml

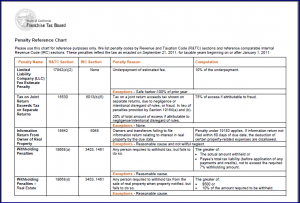

Many of our clients have come to us after having a bad tax preparation experience that resulted in penalties and interest. When we come across a reference document that we feel is valuable for the taxpayer – we promote it.

Many of our clients have come to us after having a bad tax preparation experience that resulted in penalties and interest. When we come across a reference document that we feel is valuable for the taxpayer – we promote it. Penalty reference chart (pdf)

Penalty reference chart (pdf)

Federal changed the allowable medical and dental expense deduction amount for federal purposes. A deduction is allowed for unreimbursed allowable medical and dental expenses that exceed 10 percent of federal adjusted gross income (AGI) California allows a deduction for medical and dental expenses that exceed 7.5 percent of federal AGI. For more information, go to

Federal changed the allowable medical and dental expense deduction amount for federal purposes. A deduction is allowed for unreimbursed allowable medical and dental expenses that exceed 10 percent of federal adjusted gross income (AGI) California allows a deduction for medical and dental expenses that exceed 7.5 percent of federal AGI. For more information, go to  More than 1 million Californians did not file a 2012 state income tax return!

More than 1 million Californians did not file a 2012 state income tax return!