Mid Year Tax Questions You Need To Ask Yourself

Mid Year Tax Questions You Need To Ask Yourself

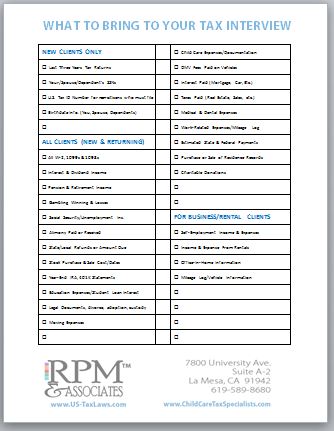

This is a good time to take a look at your present financial picture. Has your income or withholding changed in a significant way? If you are my client – then I need to know.

√ Most new tax rules affect incomes above $200K. Will these new rules affect you? If you aren’t sure how these new rules will affect your taxes, give me a call.

√ Are you sure you are withholding enough to cover your taxes? Let’s go over your information, and make sure it is where it needs to be. If it isn’t enough, and you need to make estimated tax payments, I can help you.

√ Significant changes in your income? If so, it can have a big impact on your taxes. Don’t get fooled by the “graduated tax rate”. 10% income increase can result in a 20% increase in your taxes. Don’t wait on this, call me ASAP so we can be sure you are covered.

√ Life-Changing Events? Divorce, Marriage? New Child? All these shape how the government looks at you. If there are job changes, home sale, moves, launching a new business, loss of a job or starting a new one, these are all important events that impact your financial profile. Let me know about any of these.

√ Unscheduled Income? Unemployment benefits, social security or pension, sale of an investment property or rental …. all of these can affect your tax rate also. Let me know as early as possible so we can factor them in.

When it comes to taxes, I’m in a “need-to-know” capacity. I need to know about anything that can affect your tax rate so you aren’t caught off-guard.

Have a great Autumn!

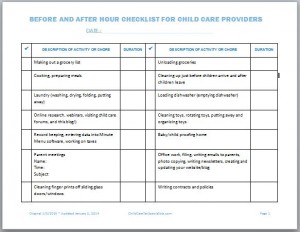

Your job starts well before children are present and goes on well after the last child has left your care. Unfortunately, it is exactly for that reason that so much of your time never gets counted, as it should.

Your job starts well before children are present and goes on well after the last child has left your care. Unfortunately, it is exactly for that reason that so much of your time never gets counted, as it should. The budget deal that Congress and President Obama struck at the beginning of the year to avoid the fiscal cliff resulted in seven tax increases. If you throw in the six tax hikes that are part of Obamacare, that means there are 13 new taxes that may have hit you in 2013.

The budget deal that Congress and President Obama struck at the beginning of the year to avoid the fiscal cliff resulted in seven tax increases. If you throw in the six tax hikes that are part of Obamacare, that means there are 13 new taxes that may have hit you in 2013. Who Must Issue 1099’s?

Who Must Issue 1099’s?  The IRS receives copy of all your tax-related forms. They are compared to your return. You can’t miss any of these documents. Watch the mail.

The IRS receives copy of all your tax-related forms. They are compared to your return. You can’t miss any of these documents. Watch the mail.

You’ve gotten a letter from the IRS. Don’t panic.

You’ve gotten a letter from the IRS. Don’t panic. IF YOU WANT TO GET CREDIT FOR CHILD and DEPENDENT CARE, THE IRS NEEDS TO KNOW…

IF YOU WANT TO GET CREDIT FOR CHILD and DEPENDENT CARE, THE IRS NEEDS TO KNOW…  TAX MOVES TO MAKE BEFORE CHRISTMAS.

TAX MOVES TO MAKE BEFORE CHRISTMAS. Now is the time to talk with your tax preparer to understand the other 2013 changes to your itemized deductions

Now is the time to talk with your tax preparer to understand the other 2013 changes to your itemized deductions Mid Year Tax Questions You Need To Ask Yourself

Mid Year Tax Questions You Need To Ask Yourself