In 2015 large employers will have annual reporting responsibilities concerning whether and what health insurance they offered to their full-time employees.

Some of the provisions of the Affordable Care Act, or health care law, apply only to large employers, generally those with 50 or more full-time equivalent employees.

Coverage

- Beginning Oct. 1, 2013, if you have 50 or fewer employees, you can purchase affordable insurance through the Small Business Health Options Program (SHOP).

- To learn more about market reforms and various plan requirements, visit HealthCare.gov Reporting

Reporting

- Effective for calendar year 2015, you must file an annual return reporting whether and what health insurance you offered your employees. This rule is optional for 2014. Learn more.

- Effective for calendar year 2015, if you provide self-insured health coverage to your employees, you must file an annual return reporting certain information for each employee you cover.This rule is optional for 2014. Learn more.

- Beginning Jan. 1, 2013, you must withhold and report an additional 0.9 percent on employee wages or compensation that exceed $200,000. Learn more.

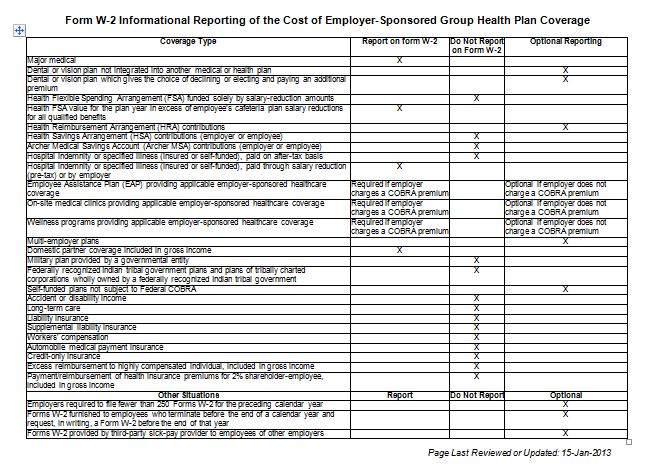

- You may be required to report the value of the health insurance coverage you provided to each employee on his or her Form W-2.

Payment & Provisions

- Effective for calendar year 2015, you may have to make a payment if you do not offer adequate, affordable coverage to your full-time employees, and one or more of those employees get a Premium Tax Credit. Learn more.

- If you self-insure, you may be required to pay a fee to help fund the Patient- Centered Outcomes Research Trust Fund